The way in which the financial services industry and in particular, retail banks, have reacted to the challenges posed by COVID-19 and its impact on customer experience trends deserves ample recognition.

Necessity might well be the mother of invention. Nevertheless, in the time it would usually take a large enterprise to conduct feasibility studies, host the necessary stakeholder meetings or tentatively agree initial scope and budgets relating to any type of change, U.S. retail banks completely undertook the digital element of a full business transformation. With their livelihood on the line, the banks wanted to do everything in their power to keep their customers banking. They worked fast to show what is possible in such a short time to improve customer experience in banking.

And this effort has not been lost on banking customers. The 2021 J.D. Power Retail Banking Satisfaction Survey shows retail banking’s average NPS score increased by 60 points between April 2020 and April 2021. This is due to the way in which the sector worked with and supported customers in the face of the pandemic and in response to new digital banking trends.

And better NPS scores are not the only improvement to the retail banking customer experience. There was a 48% decrease in customer problems or complaints while, because of the active role banks took in providing help and guidance, the sector experienced an 86% increase in potential customer retention based on consumers’ experiences during the period measured.

The Role of Customer Experience in Banking

Banks have shown that when the stakes are high enough, they can move with an unimaginable level of agility. Branches have been shuttered, staff transitioned to work at home, digital and virtual services have been made available. With it, the necessary support for customers who until the pandemic struck had prioritised a face-to-face relationship with their financial services provider, has been provided.

As recently as November 2020, 35% of U.S. consumers still preferred using traditional channels – counter service, ATMs, the mail or the phone – for managing their bank accounts. But as 2020 moved into 2021, for the first time ever, mobile apps (39%) overtook all other channels to become the most popular means for US consumers to manage their bank accounts – ahead of browser-based online banking (32%) while 10% still wanted a branch visit to be the cornerstone of their banking relationship (down from 17% just months earlier).

The New Banking Experience

It’s no surprise that COVID-19 had a tremendous impact on consumer behaviour. Today, thanks to the restrictions created by the pandemic and the necessary changes consumers have had to make to their existing habits, 41% of banked U.S. consumers are digital only when it comes to managing their finances making it one of the biggest digital banking trends.

Though initially forced on customers as a result of public health measures, many of these new behaviours and trends are set to persist and will be a central tenet of customer experience management in banking. Zooming out to look at consumer behaviour as a whole– 76% of consumers have had to move into digital channels for the first time to complete a brand interaction that they would have usually conducted face-to-face, due to COVID-19 restrictions. And crucially, because the experience was positive, 57% of this group intend to persist with online interactions. Customer experience in banking and beyond has changed; banks should be aware that consumer expectations mean they will not be reverting to the old way of doing things ever again.

The Definition of Customer Loyalty Has Not Changed

And yet, aligning with new customer experience trends in banking doesn’t mean starting again from scratch. Even as we begin to turn the COVID-19 corner, just because digital is growing in popularity, some factors relating to customer expectations and the aspects of customer experience that equate to customer service excellence in banking have either remained the same or have grown in significance.

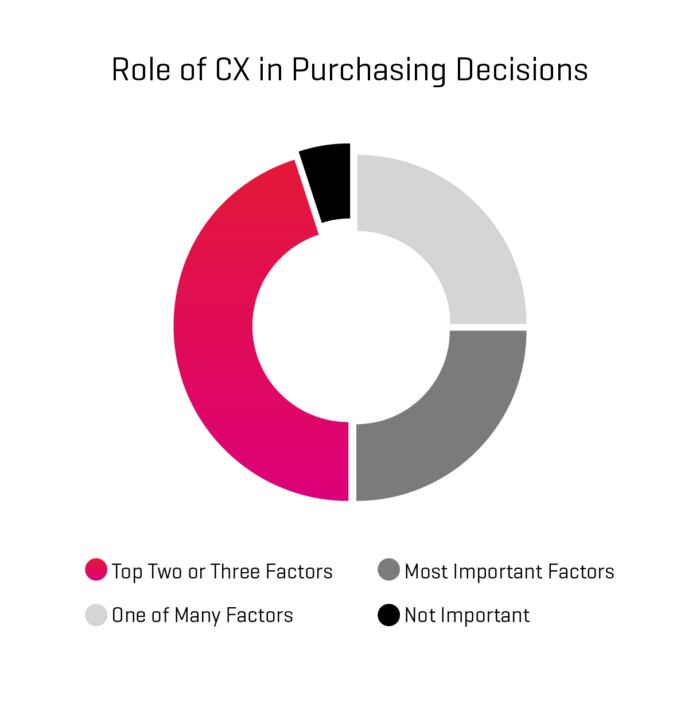

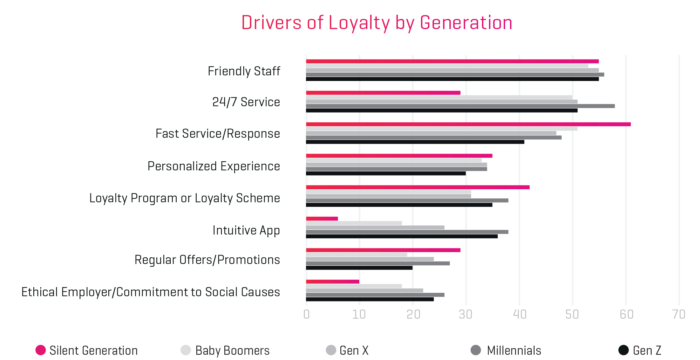

For instance, 82% of consumers say the level and quality of customer experience they hope to receive is still a deciding factor in choosing and staying with a bank, credit card or loan provider. Likewise, even following the upheaval and unique situation regarding simply operating in a business-as-usual state between the first and third waves of the pandemic, friendly staff (55%), access to 24/7 service (53%) and fast service (47%) are still the top three drivers of customer loyalty within the financial services sector.

Despite digital trends in banking, these elements are more quickly addressed through greater resources, staffing and training.

Clearly, the financial services sector is undergoing continued disruption, with the innovative use of technology driving rapid change. In this environment, brands must work hard to understand their customers’ changing perceptions of what constitutes a best-in-class experience. Established organisations need to ensure they remain relevant in the evolving landscape, while emerging brands must identify the attributes that customers value the most, helping their business grow.

How to Provide Excellent Customer Service in Banking: Make Digital Personal

Key to positive customer experience and brand loyalty is the ability for an organisation to make an emotional connection. However, moving to digital channels could make forming emotional bonds harder.

Pre-COVID-19, one of the ways banks built stronger connections was through providing – often unsolicited – advice and guidance alongside a directly requested service. That well-rehearsed line “Is there anything else I can help you with, today?” whether spoken from behind a counter or on the other end of the line contains so much potential for an elevated customer experience in banking. It’s the moment when a customer could ask a secondary, contextual question, or be prompted to articulate an issue that was until that point, at the back of their mind.

Human Intelligence and Customer Experience in Banking

It’s in these extra interactions where brands can really add the extra value – if they have knowledgeable, friendly staff with the requisite emotional intelligence and soft skills. Within the retail banking sector, there’s a direct correlation between receiving personalised financial advice and customer satisfaction.

Consumers who believe they have received advice that completely aligns with their financial situation show on average a 229-point increase (on a 1,000-point scale) in overall customer satisfaction. Just as important is that most people who receive such advice didn’t request it directly. The guidance came as part of another interaction.

However, if all touchpoints are digital, then each of these engagements is at risk of becoming a transaction rather than an interaction. This means there is a risk of going backwards in terms of the banking customer experience even if an organisation is actually moving forward in line with digital banking trends.

And this is why banks now need to concentrate on the other element of transformational journey – culture. The digital foundation has been laid but now it’s time to change focus and start looking at the business, its processes, products offers and services in terms of customer need, customer expectation and fostering long-term loyalty.

How Do Banks Build Customer Loyalty?

When the Economist Intelligence Unit analysed conversations taking place across online personal finance forums, just 2.4% of the conversations relating to FinTechs and Neo banks were on subjects associated with product, compared with 25% of all conversations relating to established banks. As a result, challenger banks are perceived as brands looking to help empower their customers, while banks are more likely to be viewed as businesses with sales targets.

There is a risk that digital engagement – unless it is in a live, non-voice channel such as online chat – can turn into a platform for pushing product, especially if interactions happen in isolation.

This is why banks now need to ensure that data captured in different digital channels and on different points along the customer journey can be harnessed and combined to get a clearer view of each customer and their personal needs and follow customer experience trends.

A better understanding enables a better level of attention where products recede into the background and the idea of combining elements of products in order to create solutions moves front and centre.

Banks Need Omnichannel Engagement

This is why an omnichannel engagement platform is key; and not because it’s a way to provide customers with access to every conceivable type of channel at any moment of the day. Rather, it is because whatever the channel mix, if they’re flowing through an engagement platform, so are the associated insights that provide the lucidity needed to meet customer expectations and business targets.

When this interactional data regarding customer history and the emotional sentiment expressed when interacting in live channels such as live chat or voice is analysed and mined correctly, banks will be able to continue perfecting the quality and performance of their digital channels, rather than simply responding to digital banking trends.

And, more importantly, banks will discover they have the ability to start crafting and tailoring new types of offering and new approaches that will better reflect their customer base and the financial challenges they face on a regular basis.

And of course, as this ability to capture data and to apply analytics reaches maturity, those insights will be of such great value to the business that it will move from being reactive to being proactive.

Top 6 Customer Experience Trends in Banking and Financial Services

1. Understand your Banking Customers’ True Experience

Transformation begins and ends by looking at how your brand is delivering from your customers’ perspectives. Leverage analytics to understand customer journeys, identify customer pain points and inconsistencies. These insights will dictate where to focus initial efforts for the greatest positive impact. But actions are only as effective as the data that supports them, therefore, the more data points analysed, the better and more detailed the roadmap will be.

2. Automate to Reduce Customer Effort in Banking

Drive customer satisfaction while reducing the resource you need to complete tasks through the intelligent application of automation. Review your customer journey map to identify areas and functions where automation could reduce effort, for example, account set up, balance inquiries or money transfers.

3. Offer 24/7 Service

More than half of banking and financial services customers want 24/7 service. Automating simple services is a good place to start, but best-in-class 24/7 service is delivered by a cognitive chatbot and intelligent IVRs ready to support customers day or night through natural conversation just as a live agent would.

4. Act with Speed

For 47% of banking and financial services customers speed is of the essence. Whether in-branch, by phone or online ensure your staff is quick to respond. Regular training is important, but giving your voice and non-voice agents access to a knowledge base ensures the most current information is always easily accessible. Combine a knowledge base with interaction analytics and the most relevant information will be presented to the agent in exactly the moment they need it. This ensures the customer gets fast and accurate information every time.

5. Stay in the Customer’s Channel of Choice

As your customers move further towards self-service options, be ready to manage escalations in their channel of choice. For example, if a customer starts a conversation with a chatbot but the query requires the conversation be escalated, the escalation path should be to a live agent via chat. For the best CX, avoid asking customers to switch channels.

6. Always Deliver Service with a Smile

Above all things, banking and financial services customers say they want to interact with friendly and helpful staff. So, don’t leave your customer interactions – whether physical or virtual – to chance. Employing interaction analytics across voice and non-voice channels supports agents and ensures your customers consistently receive the best experience possible. Making use of real-time prompts to alert agents to customer sentiment and recommend the next-best-action, also drives customer satisfaction upwards.

Financial services and banking organisations have achieved so much over the course of 2020. If they can maintain this momentum with these customer experience trends in banking in 2021, they have a huge opportunity to move even closer to their customers and even further away from their competitors.